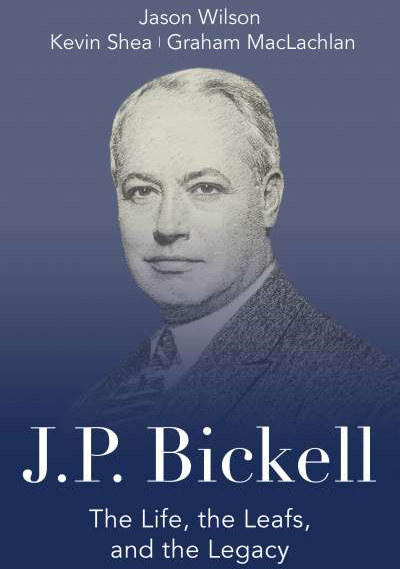

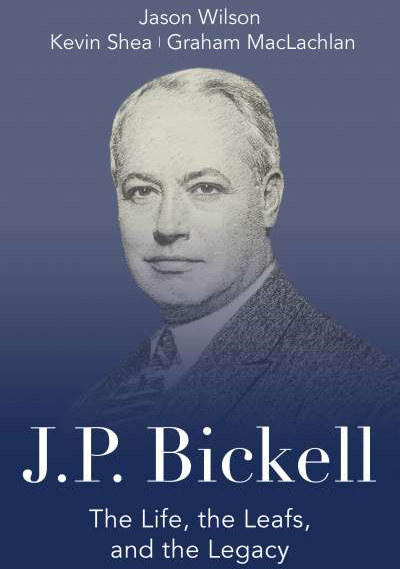

To order a copy of “J.P. BICKELL: The Life, the Leafs, and the Legacy”: https://www.dundurn.com/books/JP-Bickell

To order a copy of “J.P. BICKELL: The Life, the Leafs, and the Legacy”: https://www.dundurn.com/books/JP-Bickell

Jason Wilson is a bestselling Canadian author, a two-time Juno Awards Nominee, and an Adjunct Professor of History at the University of Guelph. He has performed and recorded with UB40, Ron Sexsmith, Pee Wee Ellis, and Dave Swarbrick. Jason lives in Stouffville, Ontario.

Kevin Shea is a renowned hockey historian and bestselling author of fourteen hockey books. He is the Editor of Publications and Online Features for the Hockey Hall of Fame, a member of the Toronto Maple Leafs Historical Committee, and a founding member of Road Hockey to Conquer Cancer. Kevin lives in Toronto.

Graham MacLachlan is a relative of J.P. Bickell who has an extensive business background in international trade that is equalled by his involvement in hockey in the IIHF, the WHL, Hockey Canada, Hockey Alberta, and Hockey Calgary. Graham lives in Calgary, Alberta.

OVERVIEW

He stayed out of the spotlight, but Leafs fans know J.P. Bickell cast a long shadow.

A self-made mining magnate and the man who kept the Maple Leafs in Toronto and financed Maple Leaf Gardens, J.P. Bickell lived an extraordinary and purposeful life. As one of the most important industrialists in Canadian history, Bickell left his mark on communities across the nation. He was a cornerstone of the Toronto Maple Leafs, which awards the J.P. Bickell Memorial Award to recognize outstanding service to the organization.

Bickell’s story is also tied up with some of the most famous Canadians of his day, including Mitchell Hepburn, Roy Thomson, and Conn Smythe. Through his charitable foundation, he has been a key benefactor of the Hospital for Sick Children, and his legacy continues to transform Toronto. Yet, though Bickell was so important both to Toronto and the Maple Leafs, the story of his incredible life is today largely obscure. This book sets the record straight, presenting the definitive story of his rise to prominence and his lasting legacy — on the ice and off.

Read more