Instead of extracting resources and leaving, we could populate the mid-Canada corridor—and create a bigger, better country

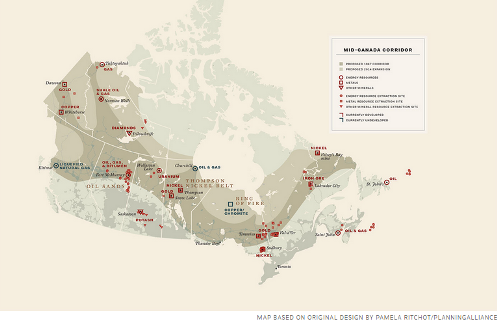

FORTY-SEVEN YEARS AGO, perhaps in the outsized spirit of Expo 67, the retired major general and author Richard Rohmer put forward a bold proposal in Mid-Canada Development Corridor: A Concept. It described a vast landmass stretching from Newfoundland and Labrador across Quebec, Ontario, and the Prairies, to British Columbia and up through Northwest Territories and Yukon, occupying the area between southern settlements and the treeline—a band dominated by boreal forest. His idea was to implement a national strategy to develop and populate it.

Rohmer reasoned that Canada was poised to be a world leader in resource extraction, and that our future was tied to that endeavour. Mid-Canada was rich in minerals, oil, and gas, largely untouched, and had a habitable climate. The key to the plan was new infrastructure, which both the government and private sector would finance.

At the time, there were a few north–south arteries in place, and more were needed; east–west links needed improvement. Some existing settlements could be expanded to serve as urban hubs. The middle of the country could be settled in much the same way the West had been settled three generations earlier, when Canada saw its future in agriculture.