Canadian Dimension is a Canadian leftist magazine founded in 1963 by Cy Gonick and published out of Winnipeg, Manitoba six times a year.

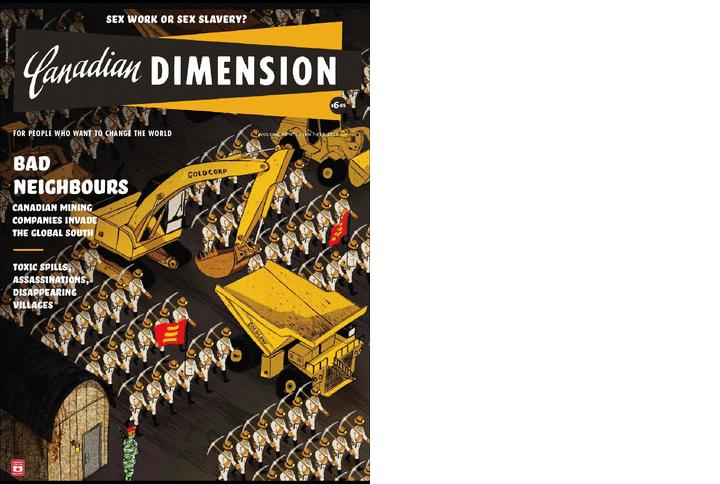

Most Canadians are not aware of it but with the help of the Canadian state, corporate Canada is beginning to throw its weight around the Global South – specifically, in metal mining locations of South America, Mexico, Africa and Asia. This has been a mainly recent development, taking off in the 1990’s but really accelerating over the past decade. Today, Canada’s metal mining industry accounts for about 12 percent of all direct investment abroad, second only to financial services.

Why are Canadian mining companies shifting their investments to the Global South? The reason is twofold. First, in Canada the easy to find ore has already been found so that new properties being developed are low-grade, high cost marginal projects. Second, besides giving diplomatic support, Canadian governments have introduced tax measures and the Export Development Corporation provides easy credit that together greatly facilitates the global expansion of Canadian mining.

Toronto is the mining finance capital of the world, raising 30 to 40 per cent of the world’s mining equity most every year, and Canadian mining companies account for a world-leading 40 percent of global exploration expenditure. As of a few years ago, companies listed on Canadian stock exchanges held interests in over 3000 mineral properties in Canada, 1400 in Latin America, close to a thousand in Africa and about 500 in each of the USA and Asia, Europe and the former Soviet Union. While mining properties in Latin America represent by far Canada’s largest interest abroad (mainly Mexico, Chile, Brazil, Argentina and Peru) Africa is the fastest growing location for Canadian mining investment, rising from $C 2.87 Billion in 2001 to 23.6 Billion in 2010.

Barrick Gold is the largest gold producer in the world. But in the global south it is known more for its human rights abuses and environmental degradation than its humongous size. “Pick a continent and you will find a Barrick run mine that has ravaged the environment and spurred social tension,” writes journalist Yves Engler. Since coming into office in 2006, Stephen Harper has gone to bat for Barrick several times. On a trip to Chile in the summer of 2007 Harper, defending the company’s controversial Pascua Lama project, assured his hosts that “Barrick follows Canadian standards of corporate social responsibility.” Later that year, traveling to Tanzania. Harper again interceded on its behalf. Barrick had just declared illegal a strike at one of its mines and was looking to replace a thousand striking miners. More disturbingly, at its North Mara mine security operatives were linked to seven violent deaths. Mine critics claimed it was part of a strategy to silence them.

In February 2009, Norway’s Ministry of Finance announced the country’s pension fund would no longer invest in Barrick due to the numerous deaths and environmental decay caused by its Porter mine in Papa New Guinea. Similarly, a recent Censored News poll found Barrick to be the fourth worst company in the world.

To better protect its world wide interests Barrick named former U.S. President George H. Bush to its board of directors shortly after his retirement along with Prime Minister Brian Mulroney. (When asked why he appointed Mulroney to his board, Peter Munk, chairman and founder of Barrick Gold, told Peter C. Newman: “He has great contacts. He knows every dictator in the world on a first name basis.”) In February 2009 Embassy magazine described Barrick’s president as a major player in one of the few areas Canada can claim to be a world leader.The magazine cited Munk as one of “the Top 50 People Influencing Canadian Foreign Policy.”

For the rest of this article, please go to Canadian Dimension’s website: http://canadiandimension.com/articles/3611/